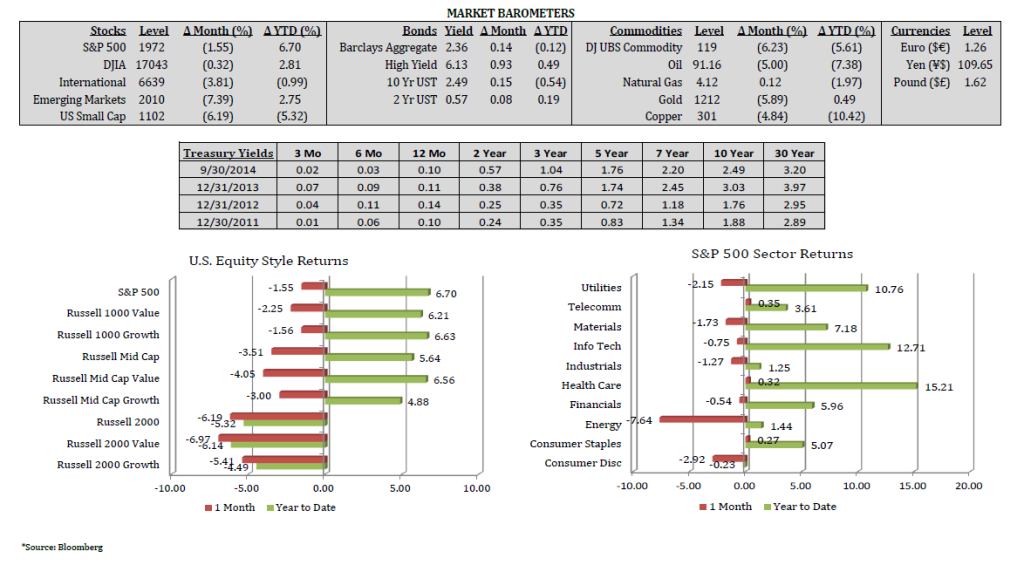

September lived up to its historical reputation as one of the worst months of the year. World events, lower global growth trajectory, Fed policy, and recent disappointing economic data combined for a tough ending to the third quarter. Stocks fell globally in September, particularly smaller capitalization and emerging markets such as Brazil (-19.2%), Turkey (-12.1%), Australia (-11.4%), and China (-6.4%). Japan and the U.S. were the best geographical performers while Latin America and Pacific ex-Japan lagged.

Globally oriented sectors such as energy, materials, and industrials felt pressure from a strengthening dollar and the challenged global growth environment. Volatility increased materially toward month end along with the frequency of troubling world events including Ebola outbreaks, ISIS/Middle East conflict, Hong Kong protests, and continued Russian/Ukrainian tensions. Contributing to market anxiety was September FOMC guidance that the Fed’s quantitative easing bond purchases will conclude in October and the likelihood of a Fed Funds rate increase by mid-2015.

Fixed income markets provided no solace as both interest rates and credit spreads moved higher on the month. Rates increased across all maturities and the yield curve flattened as shorter rates experienced a meaningful increase. 2yr and 3yr rates increased 8bps and 11bps respectively. Spreads also moved higher on the back of market anxiety. High yield spreads moved from 380bps to 440bps and investment grade moved from 112bps to 120bps over comparable US Treasuries.

Albeit somewhat dated, the BEA’s revised second quarter U.S. GDP figure increased from 4.2% to 4.6% highlighting a respectable March-June growth rebound from the winter weather induced -2.1% first quarter result. Most third quarter GDP estimates have been downgraded to approximately 3% as September’s economic releases indicate a slowdown in growth metrics across housing, manufacturing, and various consumer barometers. Headline and core inflation registered 1.7% in August, a slight drop from the July reading but have exhibited a higher trend over the past few months. While headline unemployment has improved meaningfully, currently 5.9%, the FOMC’s broader measure, Labor Market Conditions Index, has trended sideways over the past several months. Lastly, commodity markets (-6.2%) continued to struggle in September in the face of a strengthening dollar (+9% since May) and robust global oil production

Leave a Reply