Market headlines throughout June closely monitored two main drivers, Federal Reserve interest rates and the Greek debt saga. Federal reserve Chairwoman, Janet Yellen, reiterated the central bank’s policy on data dependence in the latest FOMC meeting. The Chairwoman further stated that investors should be more concerned with the path of interest rate hikes rather than the timing of the first. Despite a poor revision to first quarter GDP, the FOMC believes U.S. economic growth metrics are positioned to support higher costs of borrowing. The U.S. Bureau of Labor Statistics reported 223,000 nonfarm jobs were added to the economy in June, making it the 14th of the last 16th months to add over 200,000 jobs. Unemployment stateside fell to 5.3%, its lowest level since April 2007; yet wage growth has been subdued as the labor force participation rate fell to its lowest levels since October of 1977 at 62.6%. While corporate earnings are estimated to decline year over year for the second quarter of 2015, net profit margins remain elevated. Similarly, there have been over $1.2 trillion in mergers and acquisitions thus far year to date (an all-time record through the first six months of the year), a metric reflective of low operating costs relative to top line growth. From a consumer standpoint, sentiment has surpassed pre-recession peaks and may signal an uptick in inflation and wage growth.

Recently, the Greek debt saga has taken an unfortunate and rather unconventional turn in regards to financing external debt. Greece defaulted on their €1.6 billion payment to the internal monetary fund. The people of Greece voted against a referendum seeking further austerity measures in compliance with extending the bailout package. Finance Minister Yanis Varoufakis resigned at the bequest of Prime Minister Alexis Tsipras. Greek banks have been closed for an indefinite period as the Troika evaluates the likelihood of a second default prior to the €3.6 billion owed to the European Central bank, due in late July.

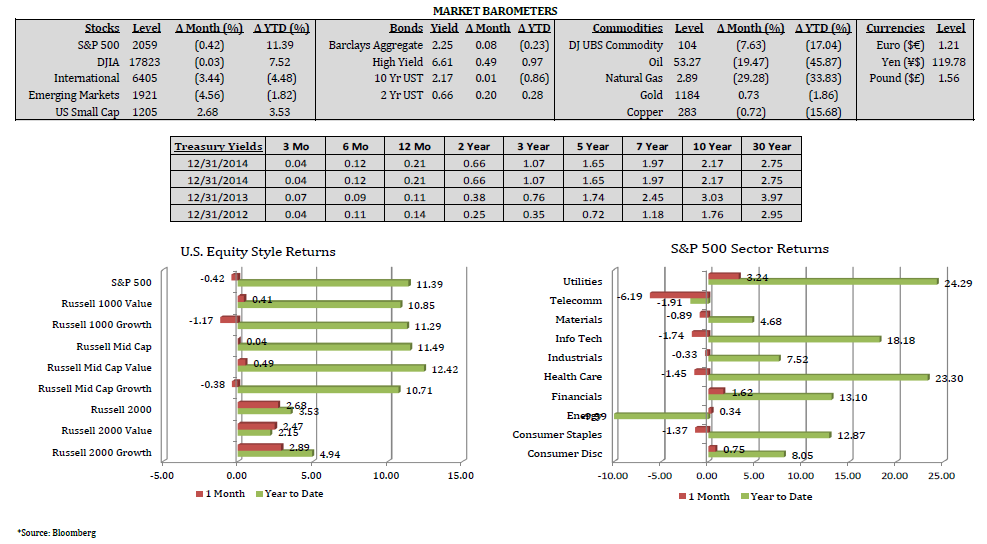

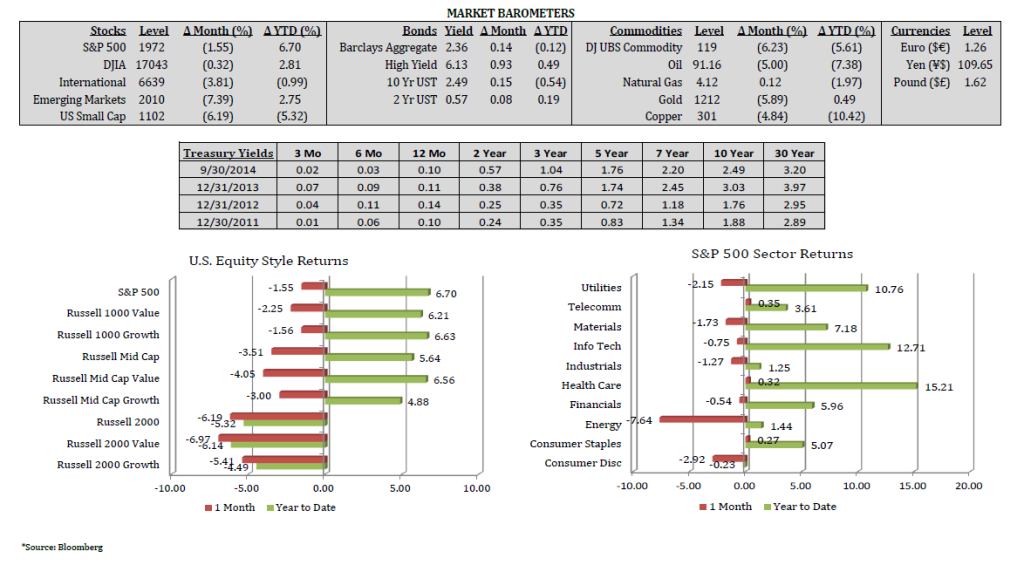

Equity markets were in the red for the month of June as increased volatility associated with Euro Area uncertainty lead investors to de-risk assets. Both the S&P 500 and Dow Jones Industry Average have been flat year-to-date. Consumer discretionary industries benefited from higher personal expenditures, likewise health care posted significant gains in response to high M&A activity. Utilities were negative in response to higher potential interest rates. Energy industries also declined relative to another drawdown in crude oil prices, the overcapacity of storage and supply outpacing demand may be the most significant attributions to these returns, (oil rig counts turned positive for the first time this year, indicating further price volatility). Fixed income markets were also generally negative for the month as Euro uncertainty and Fed comments drove up yields in the United States and abroad.