The month of July moved along in relatively benign fashion with light summer volumes and no material economic surprises, until the last day of the month. On July 31st, large caps, small caps, Treasuries, oil, credit, gold, silver, platinum, palladium, and copper all traded lower. Only the USD escaped the volatility. No clear fundamental or technical metric was a clear culprit and economic data remained on a positive trajectory over the course of the month.

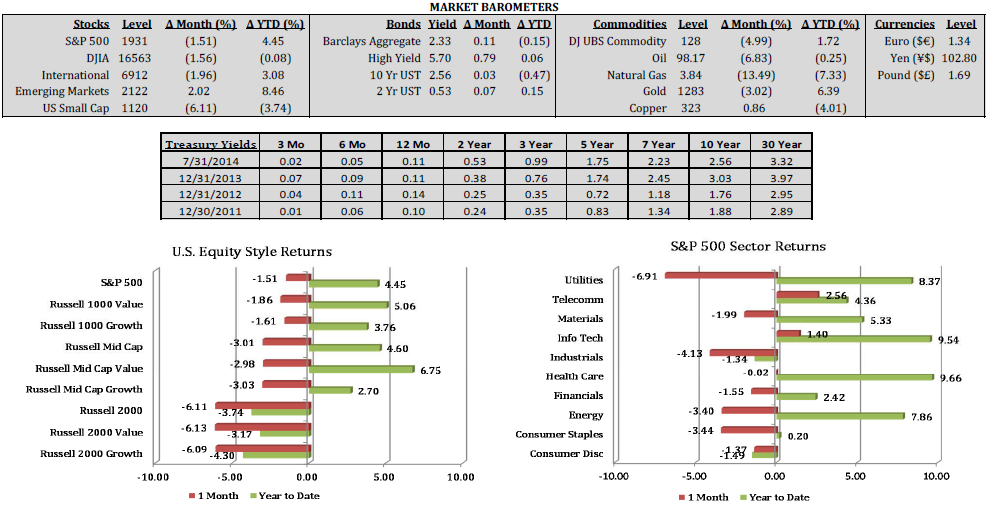

Overall, we saw equities decline across the board in July with only select emerging markets (China, Brazil, India, Mexico) and Japan posting gains. Small caps in particular bore the brunt of the selling, losing over 6% on the month. The average stock in the Russell 3000 fell 7.6% in July and 1/3 lost more than 10% on the month.

Bonds lost ground as well as rates moved higher and credit spreads widened from 350bps over comparable Treasuries to over 400bps. In fact, the 2yr U.S. treasury hit a 3yr high in July as rate on the short end began to move higher.

Strong economic data and a slightly hawkish reading of the July FOMC meeting stirred up interest rate speculation toward month end. 2Q GDP (4%) surprised on the upside, labor market indicators continued to improve, and various inflation metrics came in relatively strong including core PCE +2% and the Employment Cost Index coming in stronger than expected (0.70%).

Fundamentals look strong as second quarter earnings season was in full swing and results have surprised largely on the upside. Year over year large cap results are on pace for impressive 4.3% revenue growth and 9.9% earnings growth. Small caps are on an even more robust pace of 8.7% revenue growth and 14.7% earnings growth.

Bearish arguments point to yet another Argentinian default, Russian defiance of the international community, stretched valuations, Israeli‐Palestinian conflict, and a slowdown in the housing market. All things considered, the overwhelming accommodative stance of global central banks (37 central banks maintaining negative real interest rates) will likely remain a key driver to asset prices for the foreseeable future.