December 31st, 2014

The big theme in the final month of 2014 was the continued price collapse in the energy markets with much speculation about the wide range of drivers and implications. Oil dropped another $13 (nearly 20%) in December and finished nearly 47% off its high on the year. Ultimately both supply and demand factors have contributed to the bear market in energy. Economist Rudiger Dornbusch famously stated, “In economics things take longer to happen that you think they will, and then they happen faster than you thought they could.”

For a long time we have known of the increased supply of oil as a result of industry drilling technology advancements, production coming back online (Libya, Iraq), and the unpredictable nature of OPEC cartel production policy. At the same time, decreased demand from slowing global economic growth, increased fuel efficiency, and the emergence of alternatives have been well documented. Implications are substantial for energy producers and service companies.

Earnings pressure and credit concerns in the high yield market (energy is the largest sector in high yield market) are clear. The Russian ruble and budget implications for sovereign nations can also be pronounced but vary widely. The assault on the Russian ruble garnered many headlines as energy market collapse and Western sanctions hammered the Russian economy.

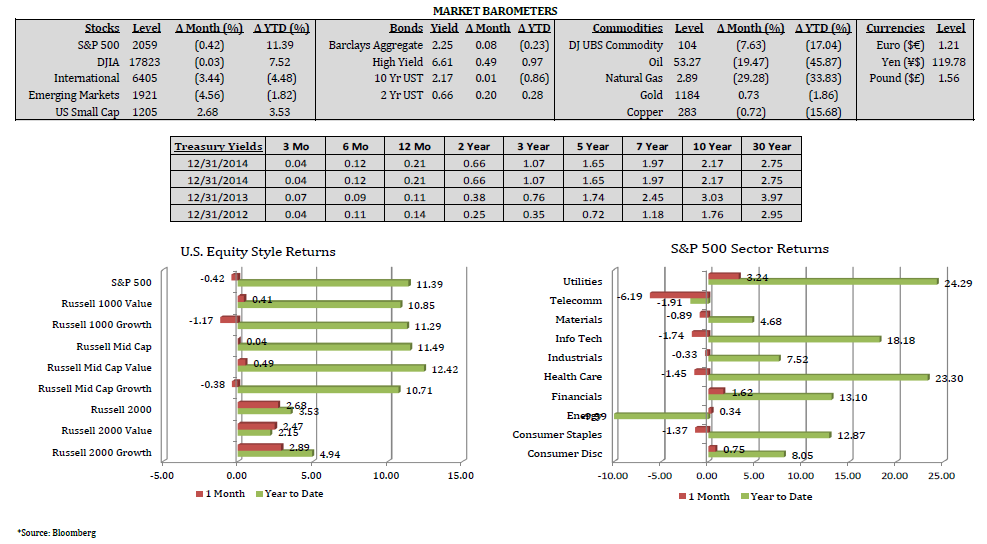

Equity markets and rates both experienced increased volatility during the month. FOMC word-smithing mid-month produced another tailwind for the U.S. dollar (particularly against the Euro) and resulted in a strong bid in the stock market as the S&P 500 posted several record highs toward month end. Interest rates stayed relatively flat for longer maturities (>7yrs) but rose sharply on the shorter maturities (<5yrs) to account for increased likelihood of Fed rate hikes in mid-2015.

The announcement of Greek snap elections in late January raised the possibility of another “Grexit” scenario where Greece exits the common currency regime, bringing back memories of Eurozone turmoil in 2011. Prime Minister Abe won another 4yr term in Japan, ensuring the use of “Abenomics” policies in the future. In the U.S., economic results remained encouraging with the exception of housing. Final 3Q GDP was revised strongly upward to 5% and labor market improvements persisted.

JAN